Choosing the Best Accounting Software for Small Business: A Complete Guide

Running a small business calls for daily task juggling. Managing your money is among the most critical ones. From tracking spending to sending bills, accounting significantly influences company success. However, completing it all by hand takes time and may result in errors. Many small business owners thus go-to accounting software. Small business accounting systems enable you to save time, remain orderly, and make wise judgments.

It provides practical instruments, including financial reports, bank syncing, and invoicing. Given so many options, choosing the correct one can be perplexing. However, you need not panic; this information will be of use. We will walk you through the top choices and features to search for. There is a great fit for your situation regardless of your starting or fast growth level.

Why Small Businesses Need Accounting Software?

Accounting software helps small businesses manage money faster, more accurately, and with less effort overall. It lets companies monitor invoices, income, and expenses in one orderly method. Errors in manual bookkeeping often result in lost receipts, missed payments, or incorrect calculations—all of which could compromise the company. Accounting software helps avoid these issues by automating procedures and centralizing all financial data. Real-time updates also let owners always know their present financial situation. This speeds and smartly guides decision-making.

Many tools include further capabilities such as tax preparation, inventory control, and payroll. These enhancements save even more time, and help cut the requirements for several systems. With just a few clicks, reports may be generated, taxes calculated, and invoices sent. Everything simplifies and gets more polished. Accounting software keeps small companies orderly, prevents mistakes, and lets them concentrate more on expansion.

Best Accounting Software Options for Small Businesses

Here are some of the best accounting tools for small business:

QuickBooks Online

Among small businesses' most reliable accounting tools is QuickBooks Online. It provides invoicing, spending tracking, bank syncing, and thorough financial reporting, among other things. The dashboard is straightforward; hence, even novices can grasp it quickly. QuickBooks can also be accessed from a mobile app, which will help you conveniently handle money wherever you go. It offers tax computations, payroll, and connections to many corporate applications. Although it costs more than other instruments, it offers strong tools for developing companies. Based on your company size and requirements, QuickBooks has several pricing schemes. Some advanced features, meanwhile, need to be upgraded to higher models. Its simplicity of use, dependability, whole features, and pricing make it a top choice even though. QuickBooks is a clever and trusted option for effectively managing your small business money if you seek a solid, all-in-one accounting solution.

FreshBooks

For independent contractors and service-based startups, FreshBooks is a fantastic choice. It emphasizes customer billing, simplicity, and ease of use. Just a few clicks using FreshBooks will let you make excellent invoices, track time, and handle costs. Because of its neat design, newcomers will find navigating and understanding the user interface simple. It provides capabilities for tracking project hours, accepting online payments, and reminding others automatically of payments. FreshBooks also offers neat financial summaries to assist you in grasping your cash flow. For first-time users, customer service is especially responsive and helpful. It also provides mobile access to keep track of your books wherever you go. Although FreshBooks is great for small teams, companies with complicated accounting requirements could not find it suitable. The count of chargeable clients determines its pricing.

Wave Accounting

Made for independent contractors and small business owners, Wave is a free accounting software. Without charge, it provides basic functions, including accounting reports, expense monitoring, and invoicing. The main benefit of Wave is that it offers these basic tools for free, which is ideal for people on a limited income. Little advanced accounting expertise is required on the platform; it is straightforward to use. It enables automatic import of transactions and connection of your bank accounts. You can also design and email professionally appearing invoices and pay online. Wave offers useful reports with financial analysis of your company. Although it's ideal for small businesses, it lacks sophisticated tools, including built-in payroll and inventory control, which would add expenses. Support choices are less than those of paid programs.

Xero

Small companies and those working with accountants will find Xero, a cloud-based accounting tool, useful. Strong capabilities, including invoicing, bank reconciliation, spending monitoring, and financial reporting, abound from it. Xero's ease of connecting with your bank and other apps is one of its strongest suits. The program lets you invite your accountant or bookkeeper to examine your records, facilitating collaborative collaboration. Xero also boasts mobile access, payroll capabilities, and inventory monitoring. For companies working with foreign customers, it facilitates several currencies. Although the UI appears contemporary, novice users may find a learning curve involved. The plans are adaptable depending on your requirements; monthly pricing is fair. Xero is built for scalability, safety, and dependability.

Zoho Books

Affordably and ideally for tech-savvy small business owners, Zoho Books is a feature-rich accounting program. It provides client portals, invoicing, expenditure management, bank connectivity, and time tracking. Since the program is a component of the bigger Zoho suite, it interacts nicely with other Zoho applications for project management, inventory, and CRM. Easy to use, Zoho Books boasts a pleasing UI and seamless processes. Automation options also abound to save time on routine chores like payment follow-up and invoice reminders. Full-featured, the mobile app lets you handle accounts from any place. It includes configurable rights and supports several users. However, Zoho's payroll is only available in a few areas so that big companies can surpass its capacity. Pricing is reasonable and gives good value for the given features.

Conclusion:

Selecting appropriate accounting software will help small business operations go much more smoothly. These tools track invoices, income, and expenses all in one location. Every program, from QuickBooks to Zoho Books, has special capabilities to satisfy various budgets and needs. Whether you run a startup, freelancer, or expanding business, there's a solution for your workflow. Good accounting programs assist in improved decision-making, save time, and lower mistakes. It keeps you orderly and attentive toward development. Choose the one that best fits your objectives; let it streamline your everyday responsibilities and strengthen your company's financial situation.

Related Articles

Getting Real Results from an Internet Speed Test

Real Work, Less Effort: The Power of Web Scraping and Automation Tools

Rank Math vs. Yoast: A Detailed Comparison to Choose the Best SEO Plugin

Unlock Text from Images: Best Free OCR Tools You Can Use Today

Choosing the Best Accounting Software for Small Business: A Complete Guide

Choosing the Right App: Web or Desktop

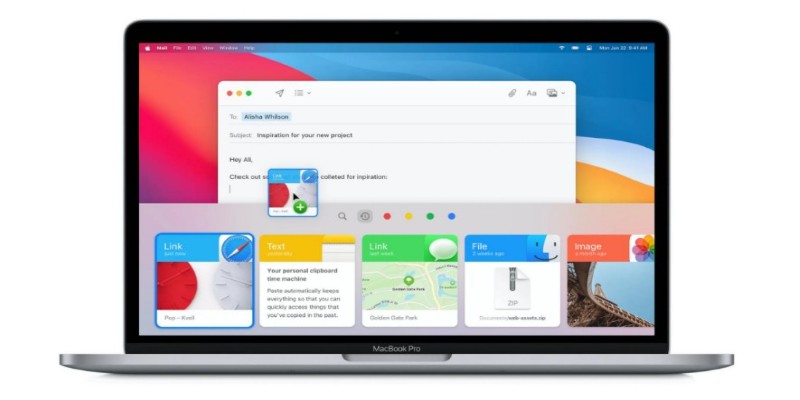

Top Clipboard Managers for Windows and Mac – Boost Your Productivity

Free AI Chatbots Compared: 5 Alternatives to ChatGPT

The Power of Online Tools: Definition, Purpose, and Impact

Smarter Scheduling: 5 Calendar Apps That Actually Help

Top 5 PAL to NTSC Converters for Hassle-Free Video Playback

knacksnews

knacksnews